Build

Equipment Financing to Build Business in Canada

Capital Financing Solutions That Help Build Your Business

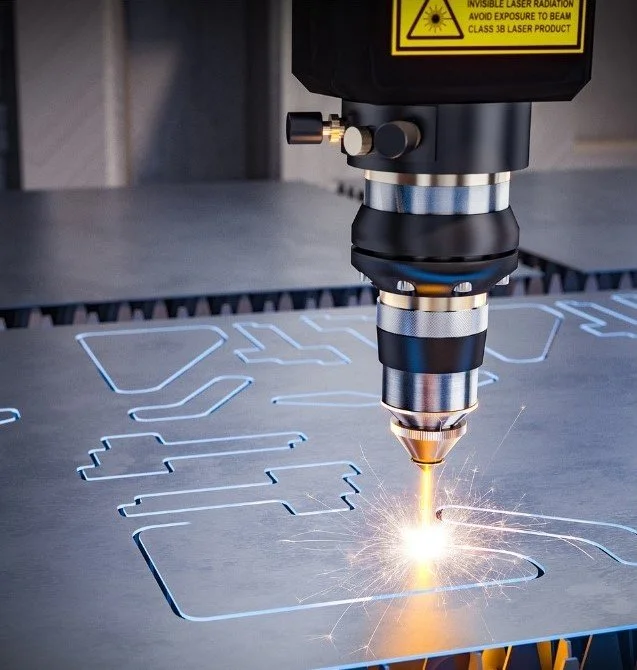

Operating a business often requires capital. To build your business, you may need to finance equipment instead of paying for it up front. But equipment financing to build a business can be difficult for startups or early-stage companies. New businesses often lack the steady revenue or assets traditional lenders want. Most banks require collateral, such as vehicles, real estate, or inventory, to approve loans. Without these, startups are frequently denied, leaving them without access to the essential equipment they need to grow.

Another issue that can prevent businesses from getting approved for an equipment loan is inconsistent cash flow. Banks want assurance that their customers will be able to make regular payments on time each month without fail, something that new businesses may not yet be able to demonstrate consistently, given their limited revenue streams and customer base. If your revenue is too low or too sporadic at this point or if your business doesn’t have sufficient assets for bank approval, our team at Canadian Equipment Finance can help with alternative funding options to get you on your way.

While every company is different, the capital financing solutions that work for many businesses include:

Capital Leases

Capital leases are a practical option for small businesses and startups that need access to essential equipment without tying up working capital. Rather than purchasing equipment outright, a capital lease allows your business to use the equipment you need while keeping funds available for expenses like inventory, payroll, or marketing.

This form of equipment leasing is ideal when traditional loans aren't an option due to limited credit or a lack of collateral. Canadian Equipment Finance offers flexible lease terms tailored to new businesses, with faster approvals than most banks.

Benefits of capital leasing:

Lower upfront costs and preserved cash flow

Tax-deductible monthly payments (in most cases)

Predictable costs and repayment terms

Option to lease new or used equipment

Our team has supported businesses across various industries, from manufacturing to logistics, with lease solutions that align with your goals.

Term Loans

Term loans are a reliable option for small businesses and startups that want to purchase equipment while retaining ownership. With a fixed interest rate and a clear repayment schedule, they offer structure and predictability, two key benefits for newer companies managing tight budgets.

Unlike many traditional lenders, Canadian Equipment Finance offers equipment loans for businesses without requiring long credit histories or large down payments. You can access capital to acquire the equipment you need, while keeping your cash available for day-to-day expenses.

Why startups choose term loans:

Fixed monthly payments and clear terms

Retain ownership of your equipment

Fast approval process

More flexible qualification criteria than banks

If you're searching for a business loan in Canada, our team can help you assess your options. Get in touch today to explore all the options available through Canadian Equipment Finance.

US Dollar Funding & Repayment Financing

For Canadian companies that work with US vendors or receive payment in US Dollars, managing exchange rate risk can be a challenge. Our US Dollar funding and repayment programs are designed to protect your business from rate fluctuations by offering a natural hedge strategy, while ensuring predictable repayments.

This type of alternative business financing in Canada is especially valuable for business owners in industries such as transportation, logistics, and manufacturing, where capital purchases are often made cross-border. We set up a dedicated US account, allowing you to repay loans using the same currency you collect from customers, without losing money to currency conversion.

How this helps your business:

Reduce foreign exchange risk and volatility

Finance equipment in US Dollars directly

Match revenue with repayments in the same currency

Improve predictability and budgeting for international operations

We can take the stress out of your cross-border capital financing or financing repayment needs today.

Why Choose Canadian Equipment Finance

Canadian Equipment Finance helps entrepreneurs and small businesses access the equipment they need with straightforward, flexible solutions. Unlike many lenders, we understand the challenges startups face when trying to qualify for financing. Our team offers practical options, whether leasing or loans, so you can focus on growth while we handle the details. With decades of industry experience and a commitment to clear, reliable service, we provide financing that works for your business today and supports your plans to expand tomorrow.

You Need More Than Just Capital Financing - We Are Here to Help!

Investing capital into your growing business is crucial for success. However, capital financing alone can leave your business vulnerable to a range of potential problems. Our team is here to help you make sure capital financing isn't all that stands between you and success.

With decades of experience financing capital for budding companies, we understand the needs of businesses at every stage and guide our clients in making wise choices that turn capital into success. We give founders the long-term financial planning advice and capital support necessary for sustainable growth.

When you work with Canadian Equipment Finance, we act as a strategic partner invested in your success. Our team has decades of experience supporting entrepreneurs and small businesses across industries, helping them secure the equipment financing to build the business they need to operate and grow. We provide straightforward, reliable capital solutions so you can focus on growth. Contact us today to speak with a financing specialist and get started with a tailored plan that fits your company’s goals.

Put our wealth of experience to work as you build your business and take advantage of the expertise we offer – find out how we can help your company today.

Startup Leasing FAQs

-

Description text gEquipment financing for startups typically involves leasing or term loan options that allow new businesses to access the equipment they need without large upfront costs. Instead of requiring significant collateral, Canadian Equipment Finance offers flexible programs designed to help startups qualify more easily while keeping cash flow available for other expenses.oes here

-

Yes. Many traditional banks require a long credit history and collateral, which startups often lack. At Canadian Equipment Finance, we provide financing solutions that consider more than just credit score. Our programs are designed to give entrepreneurs access to the right equipment even when they are still building business credit.

-

Most essential business assets can be financed, including new and used equipment across industries like construction, transportation, manufacturing, and healthcare. Whether you need startup equipment leasing or a term loan, our team will structure the right financing option to match your business needs.